Planned Giving

You may live to be 125, but today is still a good day to make an estate plan!

St. Luke’s is providing its members, attendees and school families the Transfer the Blessings Ministry FREE of charge and obligation. We believe it is our responsibility to encourage you to grow in your love and walk with the Lord through generosity. We encourage you to create an estate plan that carries out the desires the Lord has put in your heart. There will never be any obligation to include St. Luke’s in your estate plan.

Pastor Arp had a vision. A vision for assisting church members and school families with their final estate plans. It has been his desire to make this often daunting process easier for you and your loved ones both before and after the Lord has called you home to heaven. This ministry is designed to help you collect your thoughts, goals, and paperwork for your final estate plans BEFORE you see an attorney. This will save you time and money!

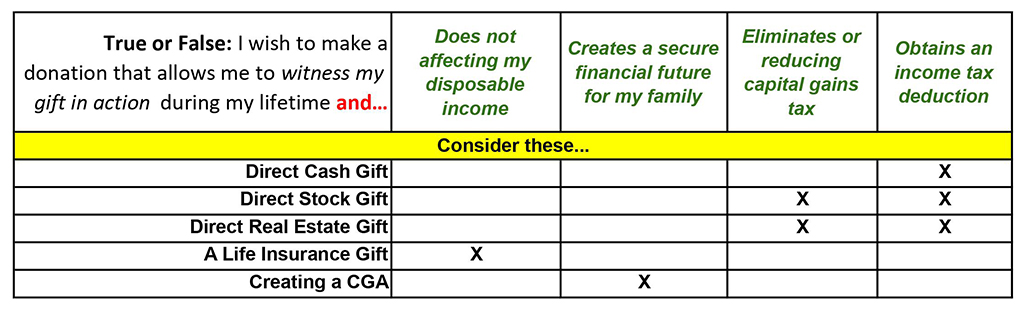

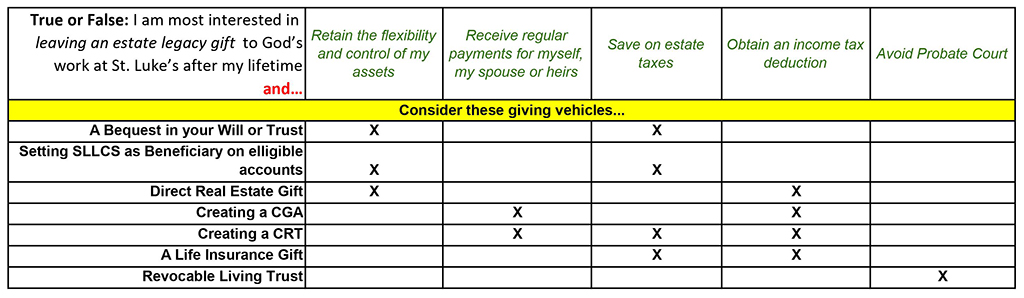

Is it your goal to support St. Luke’s with a major gift while you are living or through your estate? If so, these two charts can point you to the right giving method.

True or False: I wish to make a donation that allows me to witness my gift in action during my lifetime…

True or False: I am most interested in leaving an estate legacy gift to God’s work after my lifetime…

Creating an estate plan offers several benefits. First, the opportunity to practice true generosity and Christian stewardship as a joyful response to what the Lord has done for you. Second, it allows you to make the very best gifts to family and ministry. Finally, our expert estate planning counselors show you how to make best use of tax laws and wealth transfer principles to maximize what you share with others and minimize what is eaten up in taxes and probate fees.

TTB utilizes the power of a written plan. The LCMS Foundation calls it the Lifetime Plan for Giving process (LPFG). Our trained in-house Associate Planning Counselor, Doug Taylor (who is a St. Luke’s member), will assist you with the creation of an estate plan that maximizes your options while helping you reduce legal costs and taxes when you implement it with your attorney. Doug will guide you in asking the right questions, gather documents and provide you with educated suggestions as you work through the process. The goal is to save you time and money as you prepare you for your appointment with your estate attorney.

There is no cost for the TTB ministry services we provide. Also, you have no obligation to leave a legacy gift to St. Luke’s. Our ministry was established to bless you and your family.

- Because you desire to ensure your loved ones and favorite charities are cared for after the Lord calls you home to Heaven.

- Because you know that having a plan is good Christian stewardship.

- Because you wish to be certain your lifelong generosity goals will continue after you are in Heaven.

- Because St. Luke’s is offering this ministry at no charge or obligation to you.

- It has been estimated that when someone dies, more than 200 major decisions need to be made within the first forty-eight hours. An estate plan helps take a huge burden off of your spouse and loved ones. Plus, whether you know it or not, the State of Florida already has an estate plan ready for your loved ones to use upon your death. It’s called Probate Court. With a few simple steps through TTB, we can help them (and you) completely avoid Probate.

We have partnered with the gift planning division of the LCMS Foundation. To find out more click here: LCMS Foundation